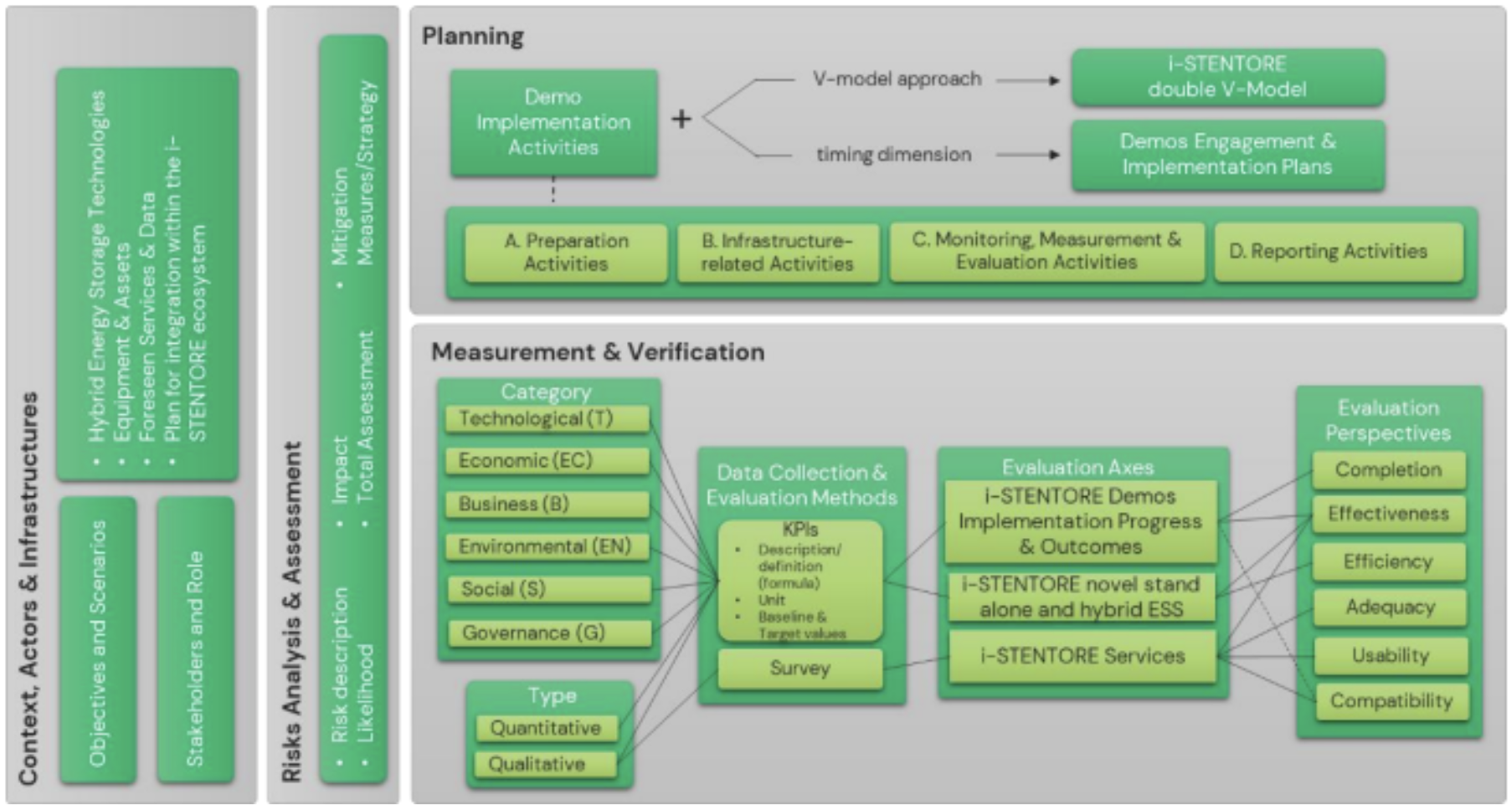

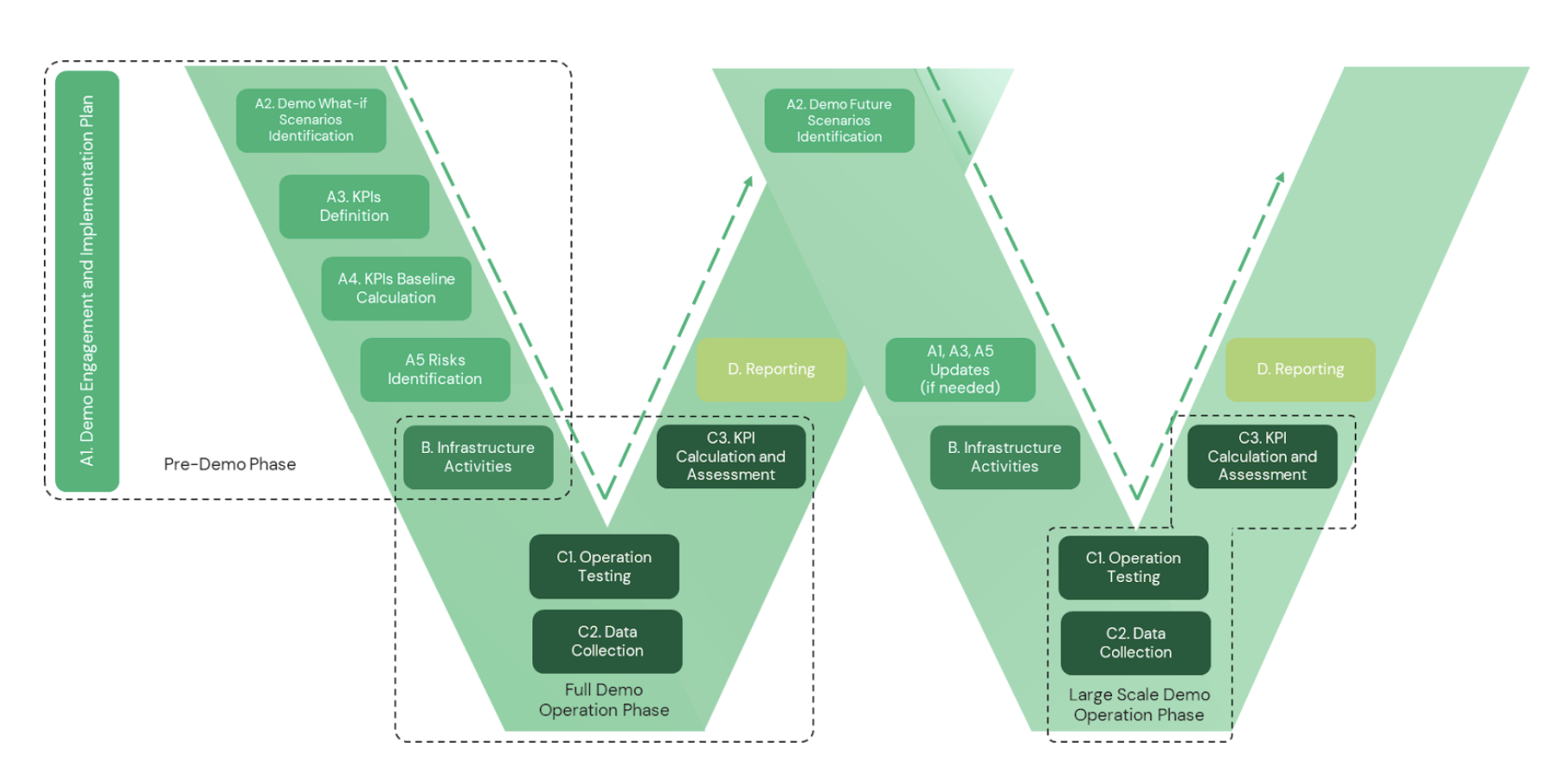

The i-STENTORE project is at the forefront of advancing innovative energy storage technologies to enable higher penetration of renewable energy in isolated systems. Demo 2, focused on Madeira Island, showcases an advanced combination of storage systems, including a Vanadium Redox Flow Battery (VRFB), lithium-ion BESS and pumped hydro, aiming to demonstrate flexibility and resilience in energy management. A crucial milestone in this pilot has been the procurement, assembly and deployment of the VRFB at INESC TEC’s lab facilities, a critical step toward real-world demonstration.

The rationale behind the VRFB in Demo 2

Madeira Island faces unique energy challenges due to its isolated grid, characterized by high reliance on thermal generation and increasing renewable integration. The VRFB was selected to be tested for its potential to offer long-duration storage, support grid stability and enable higher renewable usage without compromising system security.

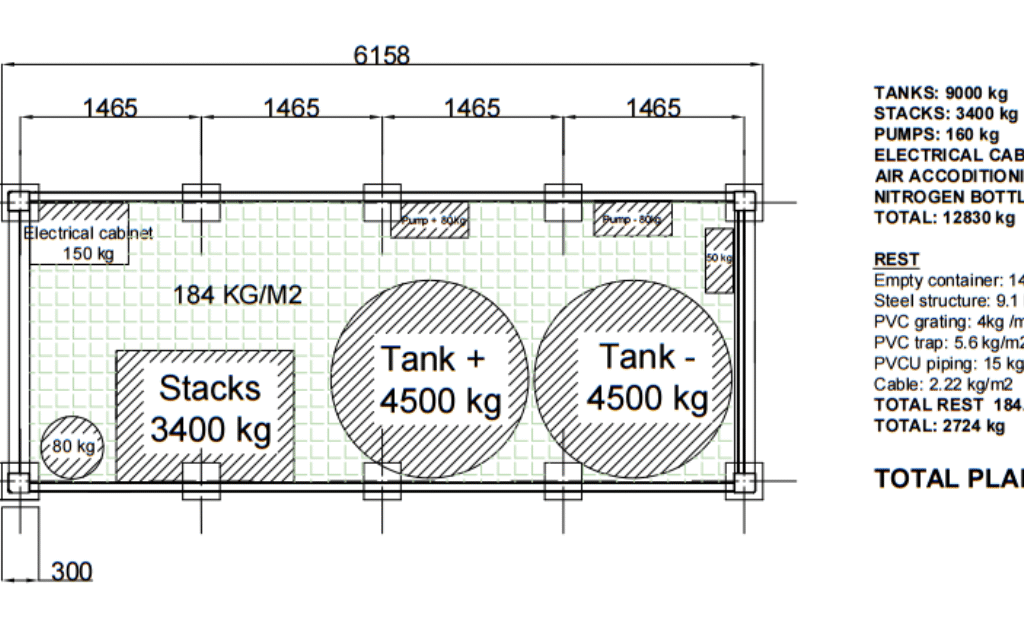

The VRFB system deployed at INESC TEC features two stacks (each rated at 25 kW), electrolyte tanks, all the required piping and pumping systems and the essential power electronics, including a dedicated power converter. Together, these components form a robust pilot-scale system capable of 50 kW/100 kWh performance.

The deployment journey

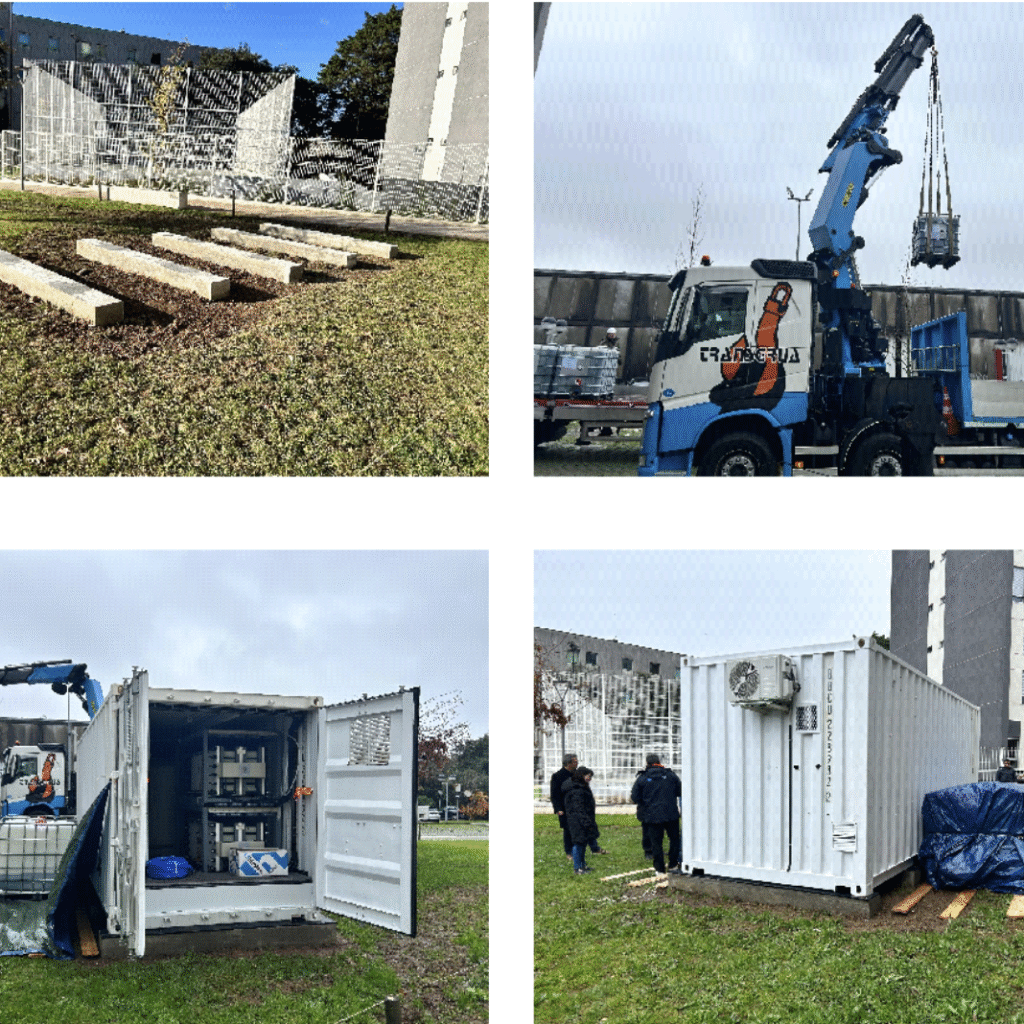

The procurement phase saw some delays, notably in the delivery of essential components such as the container, stacks, tanks and converters. Despite these setbacks, VGCoLAB capitalized on the time by preparing installation procedures and testing protocols.

By January 2025, all components had arrived, and the assembly process began promptly. The VRFB was successfully put together at VGCoLAB, followed by rigorous preliminary tests to ensure basic operational requirements.

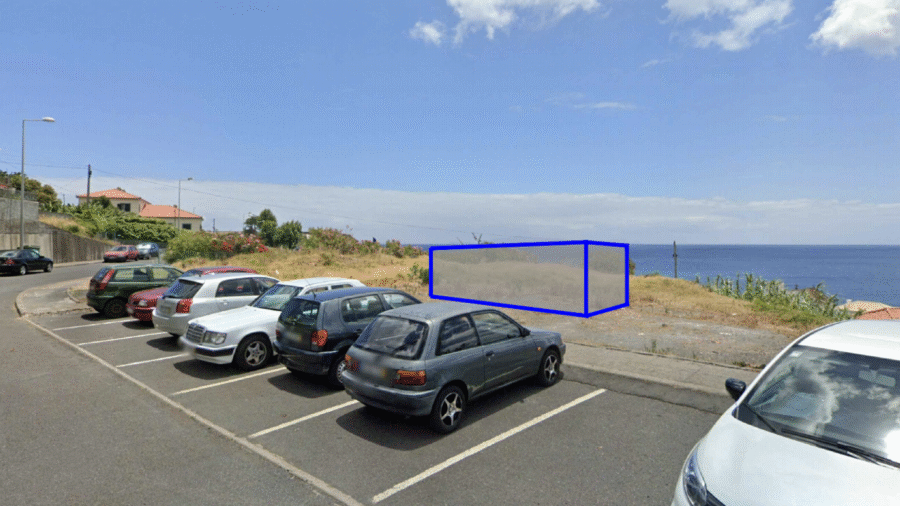

Upon assembly, the VRFB was transported to INESC TEC’s facilities. Due to the battery’s size and complexity, the installation demanded significant logistical coordination. A dedicated foundation was prepared to securely host the containerized battery. Heavy-duty trucks with cranes facilitated the careful placement of the container and auxiliary parts.

The system installation was conducted in close collaboration between INESC TEC and VGCoLAB teams, culminating in the successful deployment of the VRFB on-site. This marked a significant milestone, setting the stage for grid code compliance testing and performance assessment.

Preparing for the next steps: grid code compliance

Currently, INESC TEC is defining the grid code compliance tests that will be conducted. These tests are critical to ensure the VRFB’s ability to provide essential grid services, such as frequency regulation and voltage support, under Madeira’s grid operational constraints.

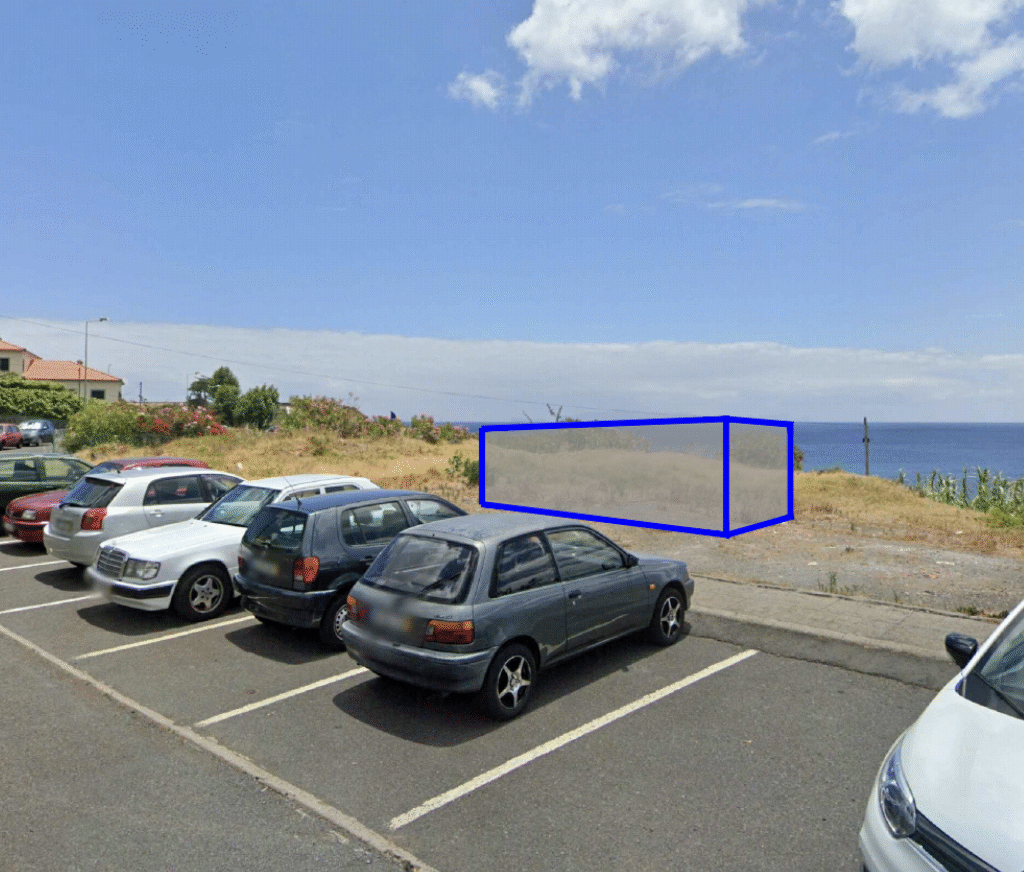

Once testing is complete and the VRFB validated, the system will be prepared for shipment to Madeira Island. There, it will be installed at the selected site by EEM (Empresa de Eletricidade da Madeira) and integrated into the local grid. The VRFB will work alongside other storage assets to optimize renewable energy usage and enhance grid reliability.

Towards a sustainable and resilient energy future

The deployment of the VRFB at INESC TEC represents a cornerstone of the i-STENTORE Demo 2 activities. Beyond technical milestones, this achievement reflects strong collaboration across partners and the potential of advanced storage technologies to reshape island energy systems.

As the project advances towards full demonstration in Madeira, the VRFB will play a key role in validating how hybrid energy storage solutions can unlock higher shares of renewables, reduce curtailment and provide essential grid services in isolated and renewable-rich environments.

Author(s): Filipe Soares (INESC TEC)

Share now!